When applying for a mortgage, your creditworthiness plays a significant role in determining your loan approval and interest rates. Two commonly referenced terms are FICO score and credit score, which are often used interchangeably but have distinct differences.

When applying for a mortgage, your creditworthiness plays a significant role in determining your loan approval and interest rates. Two commonly referenced terms are FICO score and credit score, which are often used interchangeably but have distinct differences.

1. What is a Credit Score?

A credit score is a broad term that refers to a numerical representation of a consumer’s credit risk. It is calculated based on various scoring models, including FICO and VantageScore, and is derived from credit report data such as payment history, credit utilization, and length of credit history.

2. What is a FICO Score?

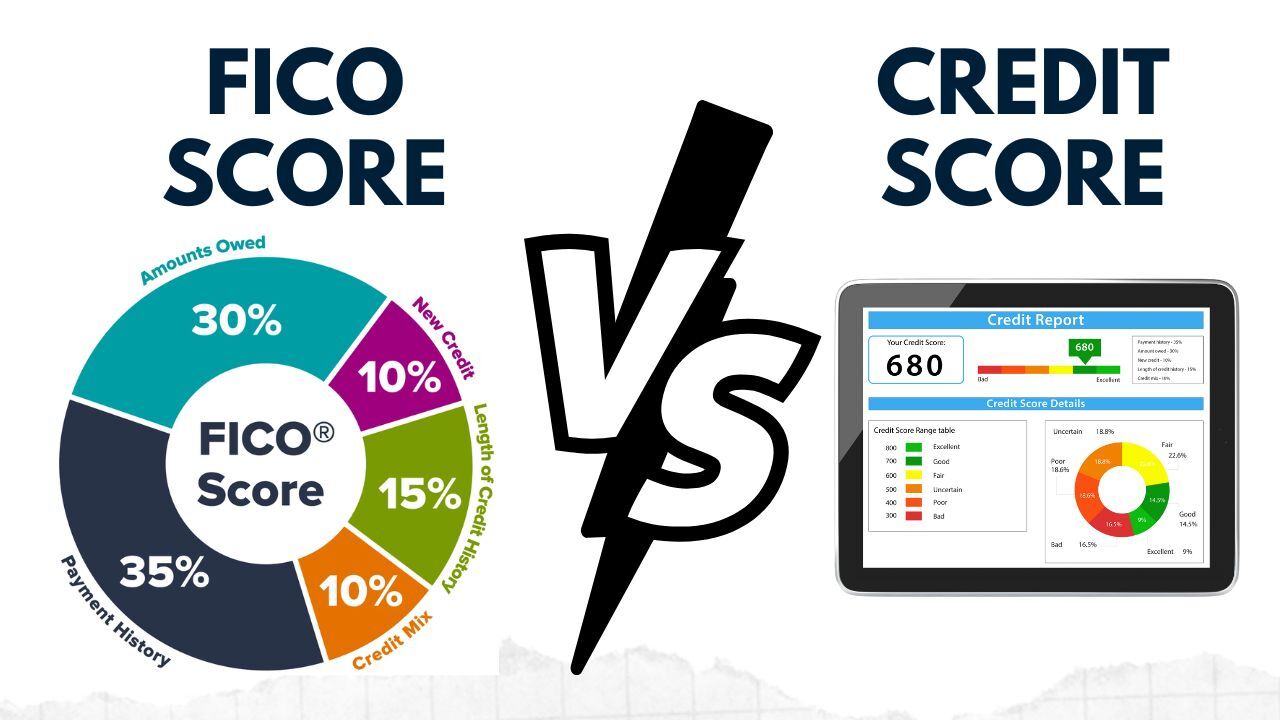

A FICO score is a specific type of credit score developed by the Fair Isaac Corporation. It is the most widely used scoring model by mortgage lenders. FICO scores range from 300 to 850 and are calculated based on five key factors:

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- Credit mix (10%)

- New credit inquiries (10%)

3. How Do They Affect Your Mortgage?

- Interest Rates: A higher FICO score typically qualifies you for lower mortgage interest rates, while a lower score may result in higher rates or loan denial.

- Loan Approval: Lenders often have minimum credit score requirements, and FICO scores are a primary factor in the underwriting process.

- Loan Terms: Your score can affect down payment requirements and loan programs available to you, such as conventional, FHA, or VA loans.

4. Key Differences

- Scope: Credit scores can come from various models, while FICO is a specific scoring model.

- Usage: Most mortgage lenders rely heavily on FICO scores for risk assessment.

- Impact: Your FICO score has a direct influence on mortgage rates and loan eligibility.

Understanding the distinction between a FICO score and a credit score is essential when preparing for a mortgage application. By improving your FICO score, you can increase your chances of securing better loan terms and lower interest rates.